The car buying process can be overwhelming, especially when deciding between cash and credit as the payment method. This blog aims to provide a comprehensive analysis of the two options, highlighting the advantages and disadvantages of each. By considering factors such as personal finances, interest rates, and credit scores, individuals can make an informed decision that aligns with their needs and financial goals. Whether opting for a cash purchase or financing with credit, this article will provide valuable insights to navigate the car buying journey successfully.

Overview of the cash and credit crunch in car buying

In the car buying process, individuals often face the decision of whether to pay with cash or finance their purchase with credit. Choosing the right method can heavily impact their overall financial situation. With cash, buyers can avoid interest charges and own the vehicle outright. However, the limited availability of funds can be a challenge. The credit crunch allows buyers to spread payments over time, but interest rates and monthly payments may increase the total cost of the car. Examining personal finances, credit scores, and future goals is essential in navigating the cash and credit options effectively.

Factors to consider when deciding between cash or credit

When deciding between paying with cash or financing a car with credit, there are several factors to consider. These include:

- Financial situation: Evaluate your current financial situation, including available cash, savings, and budget. Determine if you can comfortably afford to pay in cash without jeopardizing other financial goals.

- Interest rates: Compare the interest rates offered by lenders and consider the impact on the overall cost of the car. Higher interest rates may make financing less favorable.

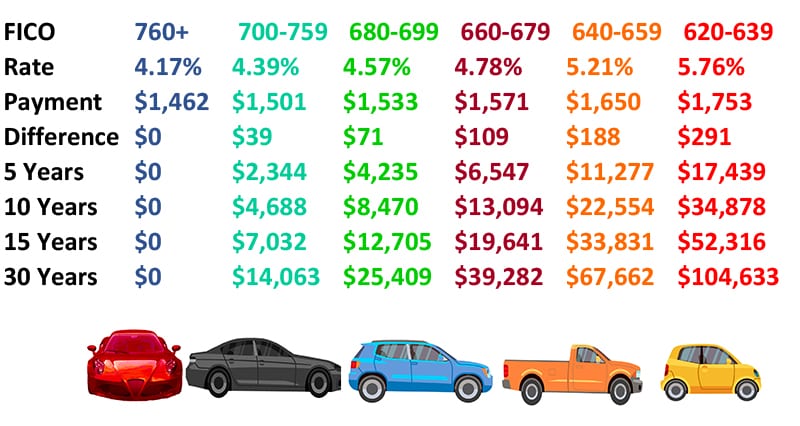

- Credit score: Understand your credit score and how it may affect your ability to secure favorable loan terms. A higher credit score can result in lower interest rates and better loan options.

- Monthly payments: Consider your monthly budget and whether you can afford the monthly payments associated with financing. Determine if the additional cost of interest is worth the flexibility of spreading out payments.

- Future goals: Consider your long-term financial goals and how purchasing a car with cash or financing it may impact those goals. Evaluate if owning a car outright or maintaining liquidity is more important to you.

By carefully considering these factors, you can make an informed decision that aligns with your financial situation and goals.

Cash Buying Method

Cash Buying Method:

The cash buying method involves purchasing a car outright using available funds, without the need for financing. This method offers several advantages, including avoiding interest payments and being able to negotiate better deals. By paying with cash, buyers also have the benefit of owning the vehicle outright and having the flexibility to sell or trade it whenever they choose. Budgeting and saving for a cash purchase can be achieved by setting aside a certain amount each month and cutting unnecessary expenses.

Advantages of buying a car with cash

Buying a car with cash offers several advantages. First, it allows buyers to avoid paying interest on a loan, which can save them a significant amount of money in the long run. Additionally, cash buyers have more negotiating power and can often secure better deals. Owning the car outright also provides the flexibility to sell or trade the vehicle whenever desired. Overall, purchasing a car with cash provides financial freedom and peace of mind.

Tips for saving and budgeting for a cash purchase

- Set a savings goal: Determine how much you need to save for your car purchase and set a realistic timeline for achieving that goal. This will help you stay focused and motivated.

- Create a budget: Assess your monthly income and expenses to determine how much you can save each month. Cut unnecessary expenses and allocate a portion of your income specifically for your car fund.

- Automate your savings: Set up automatic transfers from your checking account to a separate savings account earmarked for your car purchase. This will make it easier to save consistently and avoid temptations to spend the money elsewhere.

- Shop around for the best price: Research different car models and prices to ensure you are getting the best deal. Consider buying a used car or exploring different dealerships to find the most cost-effective option.

- Reduce other debts: Paying off outstanding debts, such as credit cards or loans, can free up additional money to put towards your car purchase. Prioritize paying off high-interest debts first to save even more in the long run.

Using these tips, you can effectively save and budget for a cash purchase of your car, ensuring that you have the financial means to make the purchase without incurring any additional debt.

Credit Buying Method

The credit buying method allows individuals to finance a car purchase through a loan. This option provides several benefits, including the ability to afford a more expensive vehicle and the opportunity to build credit history. However, it is essential to understand credit scores and interest rates to make informed decisions and avoid paying excessive amounts in the long run. Comparing different loan offers and negotiating for favorable terms can also help maximize the advantages of financing a car with credit.

Benefits of financing a car with credit

Financing a car with credit offers several benefits to buyers. First, it allows individuals to afford a more expensive vehicle that they might not be able to purchase outright. Second, financing a car with credit provides an opportunity to build and improve credit history. Lastly, it provides the flexibility to spread out the cost of the car over time, making it more manageable for many buyers.

Understanding credit scores and interest rates

Understanding credit scores and interest rates is crucial when financing a car with credit. Credit scores indicate an individual's creditworthiness and are used by lenders to determine the interest rate on a car loan. Higher credit scores result in lower interest rates, which can save buyers money over the life of the loan. It is important to monitor and maintain a good credit score to secure favorable loan terms and minimize the cost of financing a car.

Comparison and Analysis

:max_bytes(150000):strip_icc()/terms-q-quickratio-2629d7a6437841dc8f5c482c0c3f8a57.jpg)

When comparing the cash and credit buying methods for purchasing a car, there are several factors to consider. On one hand, buying with cash offers the advantage of avoiding interest payments and the potential for debt. However, financing with credit allows for the flexibility to make smaller monthly payments and potentially afford a higher-priced vehicle. It ultimately depends on an individual's financial situation, risk tolerance, and personal preference.

Pros and cons of cash and credit buying methods

When it comes to buying a car, both cash and credit methods have their own set of pros and cons.

Cash Buying Method:

Pros:

- No debt or interest payments

- Immediate ownership of the vehicle

- Negotiating power for a better purchase price

Cons:

- Requires a large upfront payment

- May limit the selection of available vehicles

- Potential for reduced savings or emergency funds

Credit Buying Method:

Pros:

- Flexibility of making smaller monthly payments

- Ability to afford a higher-priced vehicle

- Opportunity to build credit history

Cons:

- Accumulation of debt and interest payments

- Longer-term financial commitment

- Limited negotiating power due to reliance on financing arrangements

It is important for individuals to weigh these factors and consider their own financial situation and personal preferences before deciding on the best car buying method.

Factors to consider when making a decision

When deciding between the cash and credit buying methods for a car, there are several factors to consider. These include your current financial situation, including savings and available funds, the interest rates available for financing, the monthly payment amounts you can comfortably afford, and your future financial goals. It's important to carefully evaluate these factors to make the best decision for your individual circumstances.

Expert Tips for a Successful Car Buying Method

When it comes to buying a car, there are some expert tips that can help ensure a successful transaction. One important tip is to negotiate effectively, whether you're buying with cash or credit. Research the market and be prepared to walk away if the deal isn't right. Additionally, take the time to research and find the best deals available. Comparing prices, incentives, and financing options can save you money in the long run. By following these expert tips, you can navigate the car buying process with confidence and make a smart decision that suits your individual needs.

Negotiating tactics for cash or credit purchases

When it comes to negotiating the price of a car, whether you're buying with cash or credit, there are some key tactics to keep in mind. First, research the market and know the value of the car you're interested in. Use this information to negotiate a fair price. Additionally, be willing to walk away if the deal isn't right. This can give you leverage and potentially lead to better offers. Finally, be confident and assertive during negotiations, but also respectful and open to compromise. By employing these tactics, you can increase your chances of getting a good deal on your car purchase, regardless of whether you're paying with cash or credit.

Researching and finding the best deals

Researching and finding the best deals is crucial when it comes to buying a car, whether you're paying with cash or credit. Start by researching different car dealerships and online platforms to compare prices and options. Look for any ongoing promotions or discounts that may be available. Additionally, consider checking out local classified ads or online marketplaces for potential private seller deals. Don't forget to negotiate the price and consider any additional perks or incentives that may be offered by the seller. By conducting thorough research and exploring multiple options, you can increase your chances of finding the best deal on your car purchase.

Conclusion

In conclusion, deciding between a cash or credit buying method for a car purchase requires careful consideration of individual circumstances. While buying with cash offers the advantages of no interest and full ownership, financing with credit allows for greater flexibility and the opportunity to build credit. By researching and comparing options, negotiating the price, and finding the best deal, individuals can make an informed decision and choose the car buying method that best suits their needs and financial goals.

Personal considerations and final thoughts on the best car buying method

When deciding between a cash or credit buying method for a car purchase, personal considerations play a crucial role. Factors such as financial stability, long-term goals, and credit history should be taken into account. It is important to assess one's ability to make monthly payments and the impact on overall financial health. Ultimately, the best car buying method is one that aligns with individual circumstances and supports long-term financial goals. By carefully evaluating options and considering personal factors, individuals can make an informed decision that suits their needs and sets them up for success.

Making an informed decision based on individual circumstances

Making an informed decision on the best car buying method requires a careful analysis of individual circumstances. Factors such as financial stability, long-term goals, and credit history should be considered. It is important to assess one's ability to make monthly payments and the impact on overall financial health. By evaluating options and considering personal factors, individuals can make a well-informed decision that aligns with their needs and supports their long-term financial goals.