Understanding Car Insurance Policies and Coverage

Car insurance policies are contracts between insurance companies and car owners that provide financial protection against damage or theft of their vehicles. These policies offer various types of coverage, including liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Understanding the different types of coverage and their limitations is essential when choosing the right car insurance policy. Additionally, being aware of the coverage options and considering factors such as premium rates and discounts can help car owners find the best insurance policy for their needs.

A Basics of Car Insurance Policies

Car insurance policies are essential for every car owner, providing financial protection in case of accidents, damage, or theft. These policies typically include liability coverage, which covers costs related to injuries or property damage to others. Collision coverage protects against damage caused by colliding with another vehicle or object, while comprehensive coverage safeguards against theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage is also available to cover costs if the other party is at fault but lacks sufficient insurance. Car insurance policies vary in terms of coverage options and limitations, so it's crucial for car owners to understand the details of their policy and choose the one that best suits their needs.

B Different Types of Car Insurance Coverage

When it comes to car insurance, there are different types of coverage available. These include liability coverage, which covers costs related to injuries or property damage to others; collision coverage, which protects against damage caused by colliding with another vehicle or object; and comprehensive coverage, which safeguards against theft, vandalism, or natural disasters. Additionally, uninsured/underinsured motorist coverage is available to cover costs if the other party is at fault but lacks sufficient insurance. Car owners should carefully consider their needs and choose the type of coverage that best suits them.

Top Car Insurance Companies

When it comes to finding the best car insurance, there are several top-notch companies to consider. These companies are known for their excellent coverage options, customer service, and competitive rates. Some of the top car insurance companies include State Farm, GEICO, Progressive, Allstate, and USAA. It's important to compare quotes and read customer reviews to find the company that best meets your needs and budget.

A Company A: Features and Benefits

Company A offers a wide range of features and benefits in their car insurance policies. They provide comprehensive coverage, including liability, collision, and comprehensive coverage for damages and accidents. Additionally, Company A offers excellent customer service and a user-friendly online platform for policy management. They also offer various discounts and rewards programs to help their customers save money. Overall, Company A provides reliable and comprehensive car insurance options for their policyholders.

B Company B: Features and Benefits

Company B offers a range of impressive features and benefits in their car insurance policies. They provide extensive coverage, including liability, collision, and comprehensive coverage for accidents and damages. Company B stands out for their exceptional customer service and efficient claims process. They offer a user-friendly online platform for policy management and provide various discounts and rewards programs. Overall, Company B offers reliable and comprehensive car insurance options for their policyholders.

Factors to Consider When Choosing Car Insurance

When choosing car insurance, there are several important factors to consider. These include the coverage options and limitations offered by the insurance company, the premium rates and available discounts, and the reputation and financial stability of the company. Other factors to consider include the types of cars covered, the claims process, and the customer service provided. It is crucial to carefully evaluate these factors to ensure you are getting the best insurance coverage for your needs.

A Coverage Options and Limitations

When choosing car insurance, it is important to carefully consider the coverage options and limitations provided by the insurance company. These options may include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. It is crucial to understand the specific coverage limits and any exclusions or restrictions that may apply. Additionally, consider whether the company offers optional coverage add-ons such as roadside assistance or rental car reimbursement.

B Premium Rates and Discounts

Premium rates for car insurance can vary widely among different companies. It is important to compare quotes from multiple providers to ensure you are getting the best rate. Additionally, many insurance companies offer various discounts that can help lower your premium, such as safe driver discounts, multi-policy discounts, and good student discounts. Taking advantage of these discounts can result in significant savings on your car insurance premiums.

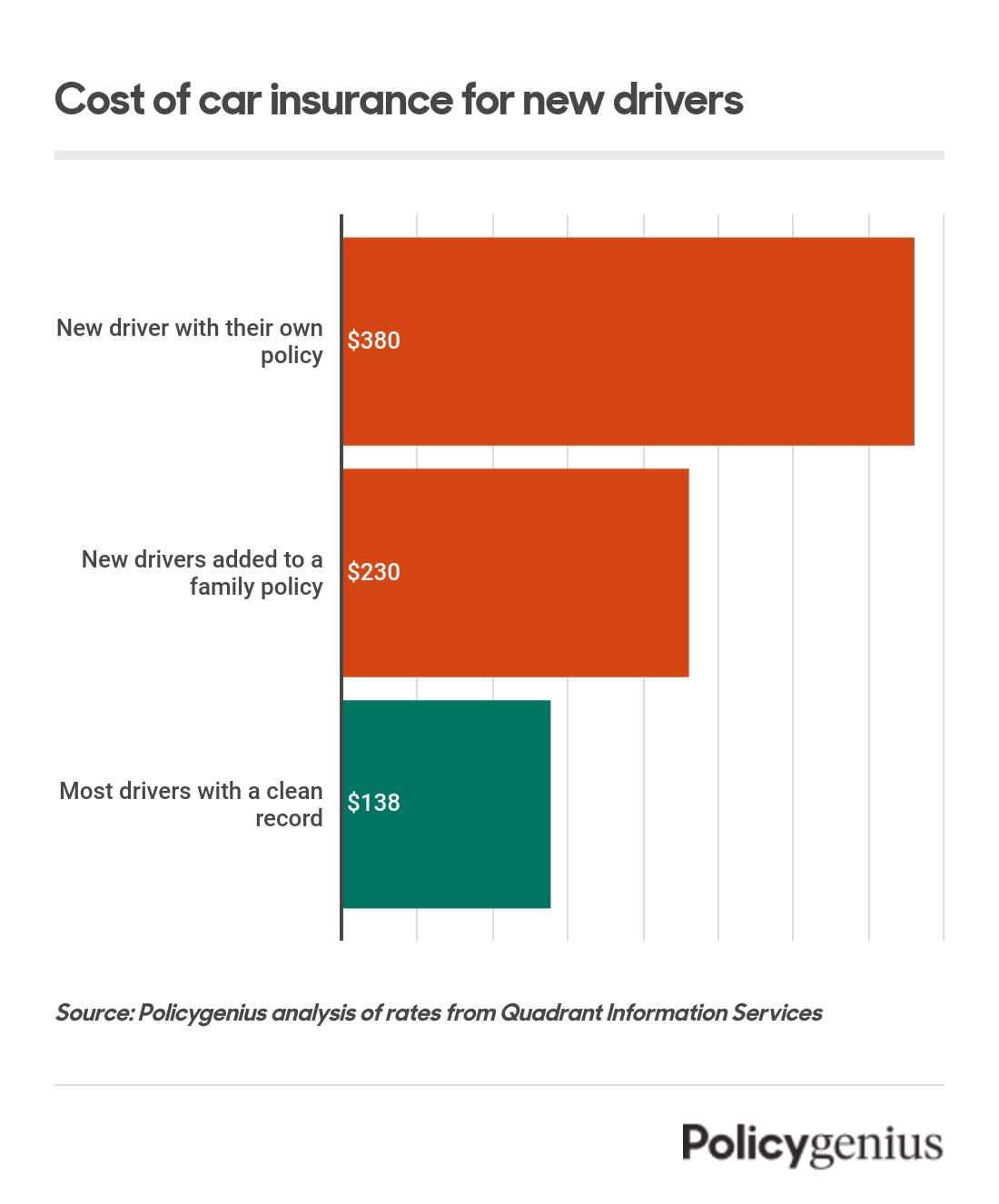

Best Car Insurance for Young Drivers

When it comes to finding the best car insurance for young drivers, it's essential to look for companies that offer competitive rates and discounts tailored to this demographic. Company A provides affordable policies for young drivers, with features such as good student discounts and safe driver rewards. Company B also offers competitive rates and flexible coverage options that cater to the unique needs of young drivers. Comparing quotes from these companies can help young drivers find the best car insurance coverage at an affordable price.

A Company A: Policies and Benefits

Company A offers a range of policies and benefits for young drivers. Their policies provide the required coverage, including liability, collision, and comprehensive coverage. Additionally, they offer discounts for good students, safe driving records, and completing driver education courses. Company A also provides options for customized coverage to meet individual needs and a user-friendly online platform for easy policy management.

B Company B: Policies and Benefits

Company B offers comprehensive car insurance policies with a wide range of benefits. Their policies include coverage for liability, collision, and comprehensive damages. Customers can also benefit from additional perks such as roadside assistance, rental car reimbursement, and accident forgiveness. Company B provides flexible coverage options and competitive premium rates. They also have a user-friendly online platform for policy management and claims processing.

Tips for Saving Money on Car Insurance

One of the best ways to save money on car insurance is to shop around and compare quotes from different insurance companies. Additionally, bundling your car insurance with other policies, such as home or renters insurance, can also lead to potential savings. Maintaining a clean driving record and opting for a higher deductible can also help lower your premium rates. Finally, taking advantage of any available discounts, such as good student or safe driver discounts, can further reduce your insurance costs.

A Comparing Quotes from Different Insurance Companies

When looking for the best car insurance, it's crucial to compare quotes from different insurance companies. By requesting quotes from multiple providers, you can easily compare the coverage options and premium rates offered by each company. This allows you to make an informed decision and choose the insurance policy that offers the best value for your money. It's important to consider both the cost and the coverage when comparing quotes.

B Bundling Car Insurance with Other Policies

Bundling car insurance with other policies can result in significant savings. Many insurance companies offer discounts when you purchase multiple policies from them, such as home or renters insurance. By bundling your car insurance, you can enjoy convenience and potentially lower premium rates. It's important to compare the bundled policy rates with standalone policies to ensure you're getting the best deal. Keep in mind that bundling may not always be the most cost-effective option, so it's worth exploring different companies and their bundled offerings.

Conclusion

In conclusion, choosing the best car insurance requires careful consideration of factors such as coverage options, premium rates, and discounts. It is important to compare quotes from different insurance companies and evaluate their bundled policy offerings. Ultimately, the best car insurance is the one that provides sufficient coverage at a competitive price, tailored to the individual's needs. By utilizing these tips and factors for evaluation, individuals can make an informed decision and secure the best car insurance for their specific requirements.

A Final Thoughts on the Best Car Insurance Options

In conclusion, selecting the best car insurance policy requires thorough research and consideration of individual needs. It is crucial to assess coverage options, premium rates, and available discounts. Comparing quotes from different insurance companies and bundling policies can help save money. Ultimately, the best car insurance option is one that provides adequate coverage at a competitive price, tailored to an individual's specific requirements. By following these guidelines, individuals can make informed decisions and secure the most suitable car insurance policy.

B Frequently Asked Questions

B Frequently Asked Questions:

- What factors affect car insurance rates?

Several factors can influence car insurance rates, including the driver's age, location, driving history, type of vehicle, and coverage options chosen. Additionally, factors such as credit score, marital status, and annual mileage may also impact premium rates.

- How can I lower my car insurance premium?

There are several ways to lower car insurance premiums, such as maintaining a clean driving record, taking advantage of available discounts, bundling multiple policies with the same insurer, and increasing deductibles. Comparing quotes from different insurance companies can also help find the most affordable options.

- What is the minimum car insurance required by law?

The minimum car insurance requirements vary from state to state. Typically, liability coverage for bodily injury and property damage is mandatory. It is essential to check with the local Department of Motor Vehicles or consult an insurance professional to determine the specific minimum coverage needed.

- What is the difference between comprehensive and collision coverage?

Comprehensive coverage protects against damage caused by non-collision incidents, such as theft, vandalism, or natural disasters. Collision coverage, on the other hand, covers damages resulting from a collision with another vehicle or object. Both coverages are optional but can provide valuable protection.

- Can I add additional drivers to my policy?

Yes, most car insurance policies allow for the addition of additional drivers. However, insurance companies may require information about the other drivers' driving history, age, and relationship to the policyholder. Adding inexperienced or high-risk drivers may increase the premium rates.

Remember to consult with an insurance professional or refer to the specific policy's terms and conditions for comprehensive and accurate answers to your insurance-related questions.